Cash transactions provide immediate liquidity, making them easy to track and manage. Step 4 Do you debit or credit the account in the journal entry? According to the rules of debits and credits, an increase in an asset is recorded with a debit. By following these five steps, you can effectively analyze and record accounting transactions, maintaining accurate financial records for your business. The first step is to identify the transaction or event that has occurred and needs to be recorded. This could be a sale of goods or services, purchase of inventory or equipment, receipt of cash, payment of expenses, etc.

Explore Business Topics

Even though the districts never paid early, thedid make payments within the 30 day grace period. The small not-for-profit Christine Chang startedin graduate school, Promoting All Students’ Success (PASS), wasmore successful than she had imagined. She had taken an educationpolicy course in graduate school in which she learned about thedisparities in achievement gaps as a result of chronic underfundingin the public schools.

- They wanted to enrolltheir children in the tutoring program starting January 2016.

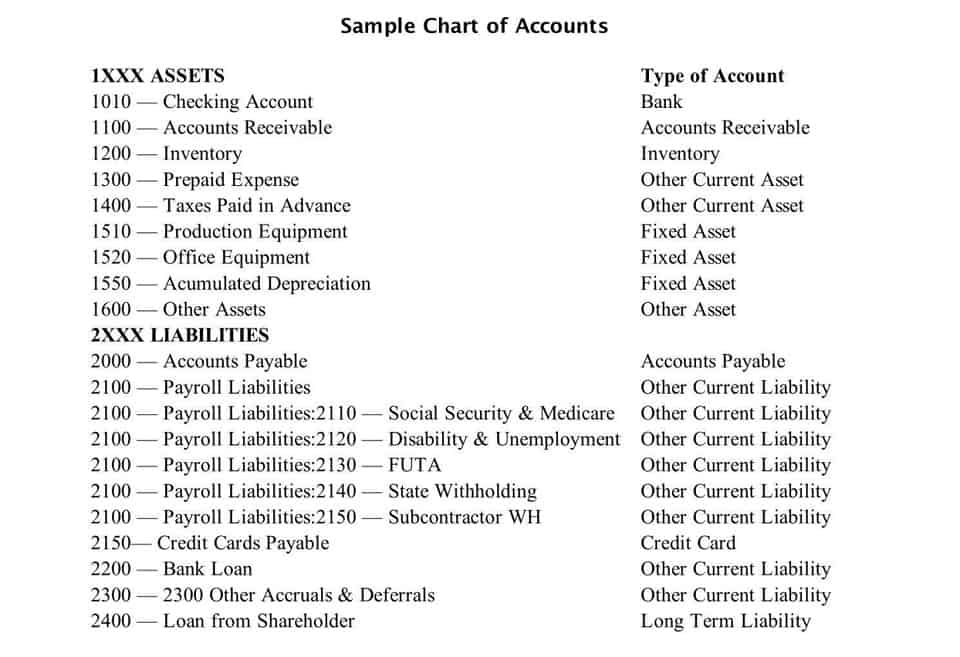

- Our Chart of Accounts has a Rent Expense account for us to record rent.

- IfTreehouse buys $500 of supplies, it will record those supplies onits balance sheet at the $500 it cost to acquire them.

- Theremaining $8 million will become available later, so for now, it’sconsidered deferred revenue.

- We’ll also dive into how transactions work and why they play such a vital role in financial reporting.

Income Statement

The continued equilibrium of the accounting equation does exist here although it is less obvious. On the statement of retained earnings, current net income becomes a component of retained earnings. The reduction in https://www.facebook.com/BooksTimeInc/ income here serves to decrease retained earnings. Because both assets and retained earnings go down by the same amount, the accounting equation continues to balance. By using T-accounts, accountants can visually track and analyze the impact of transactions on specific accounts. This method helps ensure accuracy and facilitates the preparation of financial statements, such as balance sheets and income statements, based on the recorded transactions.

Step 1: Identify the transaction

Step 1 The business paid $2,300 in exchange for employee services, for the use of the building, and for utilities consumed as part of operating the business. The accounts involved in the transaction are Salaries Expense, Rent Expense, Utilities Expense, and Cash. Step 1 Bold City Consulting received cash from the bank in exchange for a signed note agreeing to pay the cash back in two years. The accounts involved in the transaction are Cash and Notes Payable. In this step, we determine which account is to be debited and which one is to be credited on the basis of the increase and decrease in accounts identified in the preceding step. The second step of https://www.bookstime.com/ transaction analysis is to ascertain the nature of the accounts identified in the preceding step.

- The business received cash in exchange for stock, so the accounts involved are Cash and Common Stock.

- Investments the organization intends to holdlonger than one year, or that are less liquid, are known simply asinvestments.

- If we subtract the salvage value from thehistorical cost, and divide by the useful life, we get the annualdepreciation expense.

- Meaning, will the informationcontained on this original source affect the financial statements?

- Assets have gone up by $2,000 while the liability side of the equation has also increased by the same amount to reflect the source of this increase in the company’s assets.

- The accounting cycle procedure begins immediately upon the occurrence of a business transaction.

- Transactions can be external transactions or internal transactions.

We aren’t concerned with Joe Smith’s personal accounting. Step 2 Salaries Expense, Rent Expense, and Utilities Expense are expenses; Cash is accounting transaction analysis an asset. Step 3 The asset Accounts Receivable and the revenue Service Revenue are both increased. Bold City Consulting collects $2,600 cash for services provided.

Double Entry Bookkeeping

Then, we move to journal entries where students use the rules of debit and credit to increase and decrease accounts. Double-entry bookkeeping is the accounting method you use to track where your company’s money comes from and where its money goes. As the name implies, there are two entries involved in this process, which involves a debit and a credit.

The chart below presents these concepts as a flowchart. Recall that inthis transaction Treehouse agreed to purchase audiology equipmentand pay for it later. To reference the flow chart, this transactiontherefore starts on the bottom left corner of the chart at “Receivea Good – Received.” Has it made a payment for that good?